Promotion

Use code MOM24 for 20% off site wide + free shipping over $45

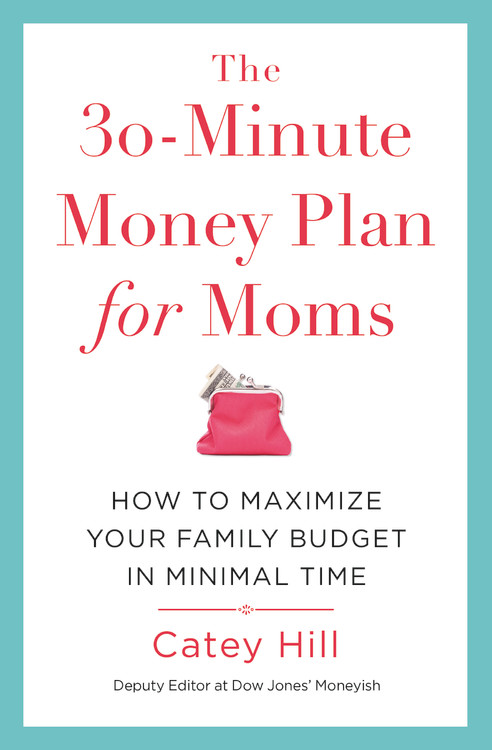

The 30-Minute Money Plan for Moms

How to Maximize Your Family Budget in Minimal Time

Contributors

By Catey Hill

Formats and Prices

Price

$15.99Price

$20.99 CADFormat

Format:

- Trade Paperback $15.99 $20.99 CAD

- ebook $9.99 $12.99 CAD

- Audiobook Download (Unabridged)

This item is a preorder. Your payment method will be charged immediately, and the product is expected to ship on or around April 24, 2018. This date is subject to change due to shipping delays beyond our control.

Also available from:

Let’s face it, kids are expensive — in 24 states, daycare actually costs more than in-state college tuition! And the older kids get, the more you will spend. Every mom could use more money. But who has hours to search for coupons just to save a few dollars? And sure, you know you should learn how to get the most of your 401k, but when will you possibly find the time?

Luckily, financial expert Catey Hill has created smart, simple strategies to help you maximize your money in minimal time (yes, even your 401k). Drawing on extensive research and exclusive studies on the actual cost of raising a child at each age, she’ll show you how to save in each area of your life, including practical tips on:

Shopping second-hand vs. what to buy new and where- Lowering your grocery bill (without coupons!)

- Building up a college fund

- Dealing with high interest credit card debt

- Saving on insurance

Best of all, these tips are designed to be done in less than half an hour, and the few things that might take a little longer are broken down in 30-minute segments. Catey will even guide you through a one-time five-step process that will allow you to manage all your bills, keep an eye on the family budget, and build savings for that dream family vacation in just 30 minutes a week, so you can stress less and enjoy your life more!”A handy resource for any parent trying to figure out how to balance a family budget.” — Soledad O’Brien, anchor of Matter of Fact with Soledad O’Brien

“An indispensable guide for parents who want to gain control of their finances.” — Elizabeth Willard Thames, author of Meet the Frugalwoods

Genre:

- On Sale

- Apr 24, 2018

- Page Count

- 288 pages

- Publisher

- Center Street

- ISBN-13

- 9781478975656

Newsletter Signup

By clicking ‘Sign Up,’ I acknowledge that I have read and agree to Hachette Book Group’s Privacy Policy and Terms of Use