Promotion

Use code MOM24 for 20% off site wide + free shipping over $45

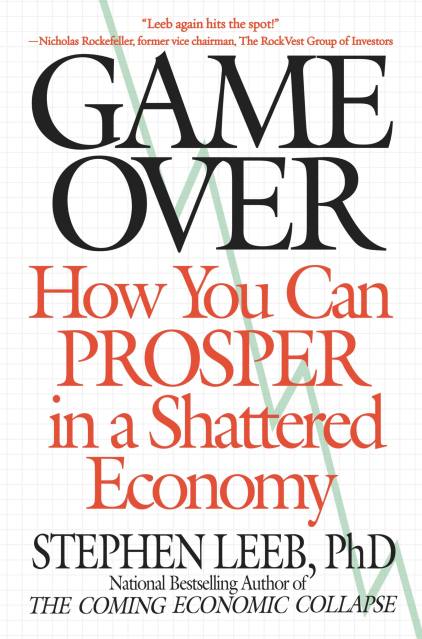

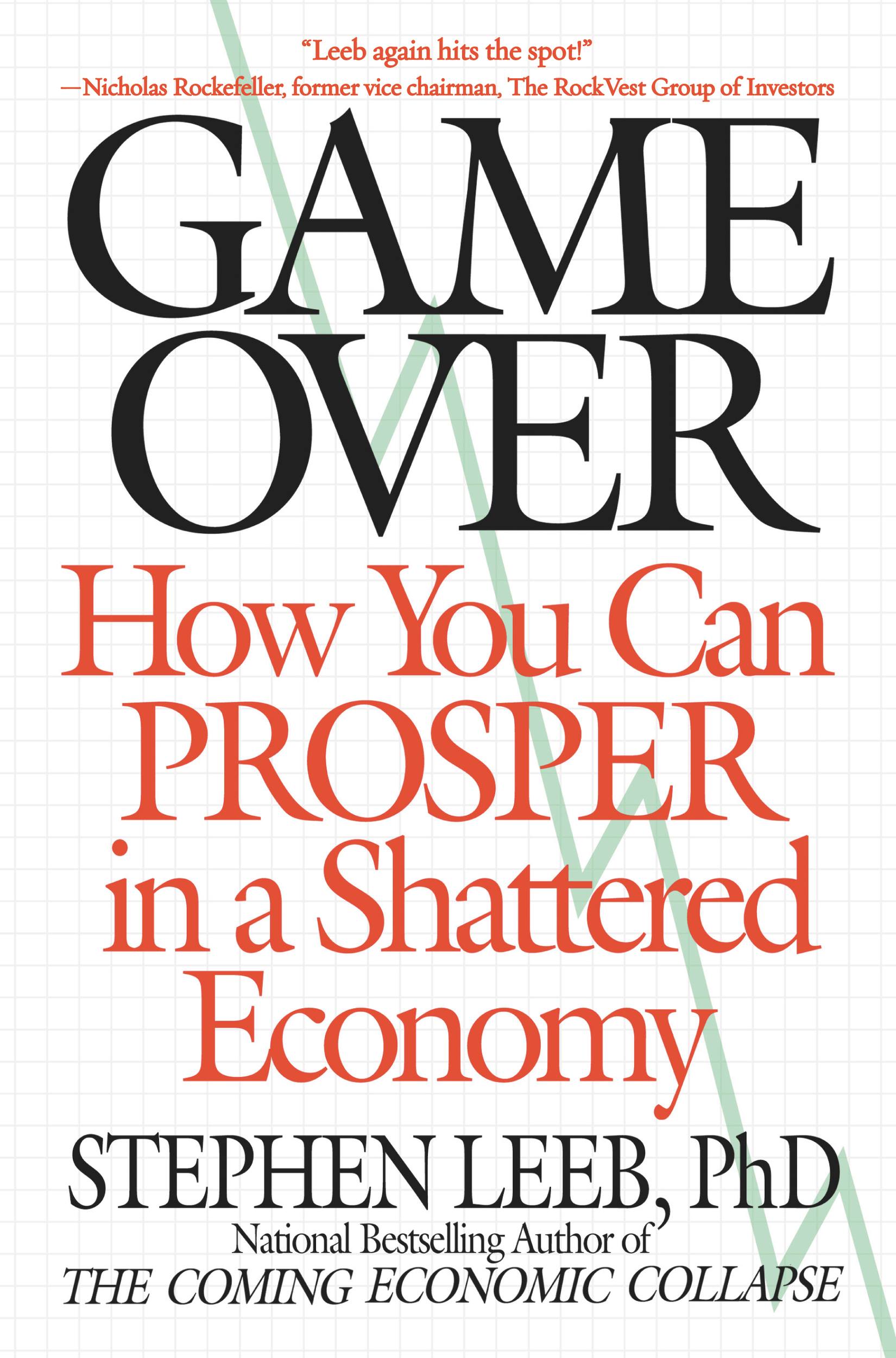

Game Over

How You Can Prosper in a Shattered Economy

Contributors

By Stephen Leeb

Formats and Prices

Price

$9.99Price

$12.99 CADFormat

Format:

- ebook $9.99 $12.99 CAD

- Trade Paperback $19.99 $25.99 CAD

This item is a preorder. Your payment method will be charged immediately, and the product is expected to ship on or around January 28, 2009. This date is subject to change due to shipping delays beyond our control.

Also available from:

You already know about the devastating recession we’re in. Jobs are being cut by the tens of thousands. Real estate values are plummeting. Retirement plans and 401ks are going up in smoke. And then there’s rising inflation. And whether we like it or not, higher gasoline prices again are right around the corner.

Then there’s the ever-present confusion and dips in the stock market, and, whether we want to admit it or not, the fact that the world is finally beginning to run out of essential raw materials, such as silver, titanium, and, of course, oil.

Yes, the economy is definitely a wreck. Even worse, according to most experts, our problems are not going away soon. We’re going to be in serious financial trouble for a long time.

So . . . are you ready for some good news?

As you will discover in Game Over, bestselling author and investment advisor Dr. Stephen Leeb shows you how to not only survive in the current economic maelstrom but actually find a way to thrive.

Dr. Leeb first tells you just how bad things are by exposing the basic suppositions of our institutions, and how quickly outdated they’ve become. Warning bells are sounding especially for Americans looking forward to a relaxing retirement and living off their savings, investments, Social Security, and Medicare. The time to sit up and take action is now.

Dr. Leeb provides a clear-cut and well-crafted financial road map to protect every investor in the years to come. Specifically, he reveals which key investments will steadily rise . . . the best ways to hedge surging inflation . . . and which sectors will boom.

Many will lose their savings, watch their investments shrink, and never fulfill their financial dreams. But with Dr. Leeb’s advice, you can make sure yours come true.

Then there’s the ever-present confusion and dips in the stock market, and, whether we want to admit it or not, the fact that the world is finally beginning to run out of essential raw materials, such as silver, titanium, and, of course, oil.

Yes, the economy is definitely a wreck. Even worse, according to most experts, our problems are not going away soon. We’re going to be in serious financial trouble for a long time.

So . . . are you ready for some good news?

As you will discover in Game Over, bestselling author and investment advisor Dr. Stephen Leeb shows you how to not only survive in the current economic maelstrom but actually find a way to thrive.

Dr. Leeb first tells you just how bad things are by exposing the basic suppositions of our institutions, and how quickly outdated they’ve become. Warning bells are sounding especially for Americans looking forward to a relaxing retirement and living off their savings, investments, Social Security, and Medicare. The time to sit up and take action is now.

Dr. Leeb provides a clear-cut and well-crafted financial road map to protect every investor in the years to come. Specifically, he reveals which key investments will steadily rise . . . the best ways to hedge surging inflation . . . and which sectors will boom.

Many will lose their savings, watch their investments shrink, and never fulfill their financial dreams. But with Dr. Leeb’s advice, you can make sure yours come true.

Genre:

- On Sale

- Jan 28, 2009

- Page Count

- 256 pages

- Publisher

- Business Plus

- ISBN-13

- 9780446557368

Newsletter Signup

By clicking ‘Sign Up,’ I acknowledge that I have read and agree to Hachette Book Group’s Privacy Policy and Terms of Use