Promotion

Use code MOM24 for 20% off site wide + free shipping over $45

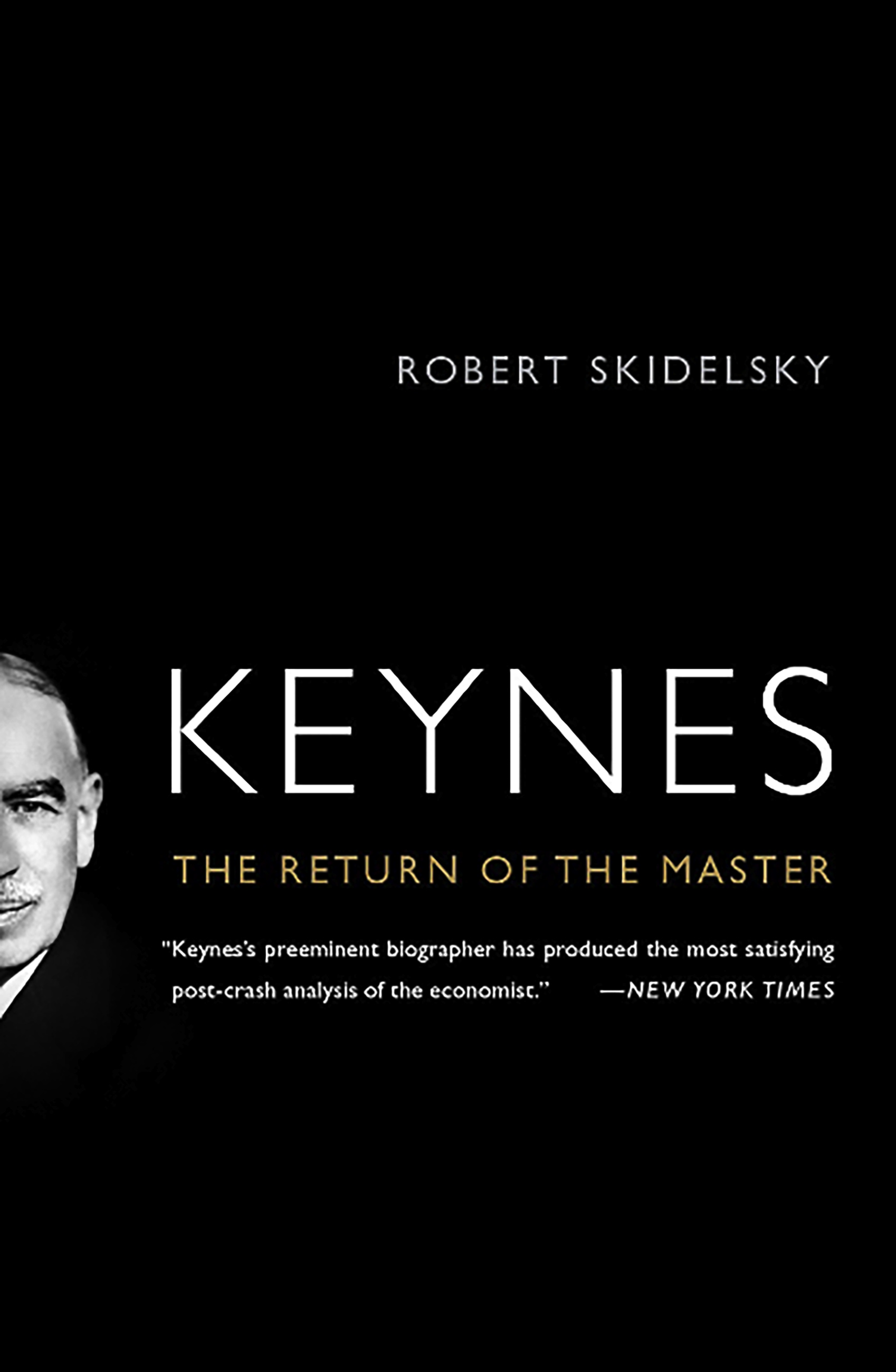

Keynes

The Return of the Master

Contributors

Formats and Prices

Price

$19.99Format

Format:

- Trade Paperback $19.99

- ebook $9.99

This item is a preorder. Your payment method will be charged immediately, and the product is expected to ship on or around October 26, 2010. This date is subject to change due to shipping delays beyond our control.

Also available from:

Genre:

-

Foreign Affairs

“The book offers clear and cogent critiques of modern macroeconomic thought, along with a brief but useful summary of what went wrong in 2007-9.”

Financial Times, October 18, 2010“Skidelsky’s succinct, lively, unashamed paean analyses Keynes’s core values and offers a persuasive pitch for the contemporary relevance (and necessity) of his ideas.”

- On Sale

- Oct 26, 2010

- Page Count

- 256 pages

- Publisher

- PublicAffairs

- ISBN-13

- 9781586488970

Newsletter Signup

By clicking ‘Sign Up,’ I acknowledge that I have read and agree to Hachette Book Group’s Privacy Policy and Terms of Use