By clicking “Accept,” you agree to the use of cookies and similar technologies on your device as set forth in our Cookie Policy and our Privacy Policy. Please note that certain cookies are essential for this website to function properly and do not require user consent to be deployed.

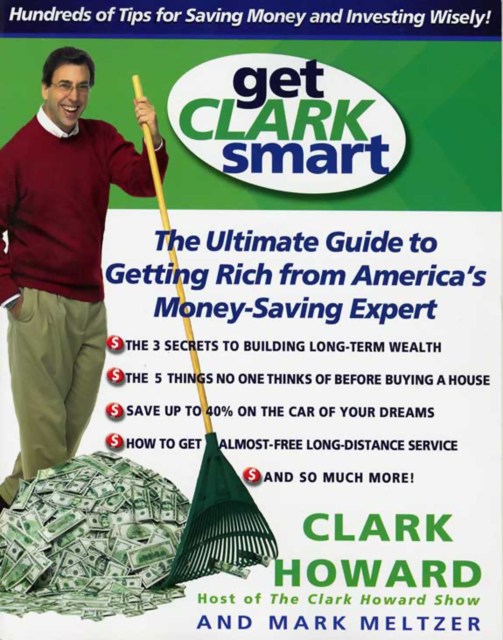

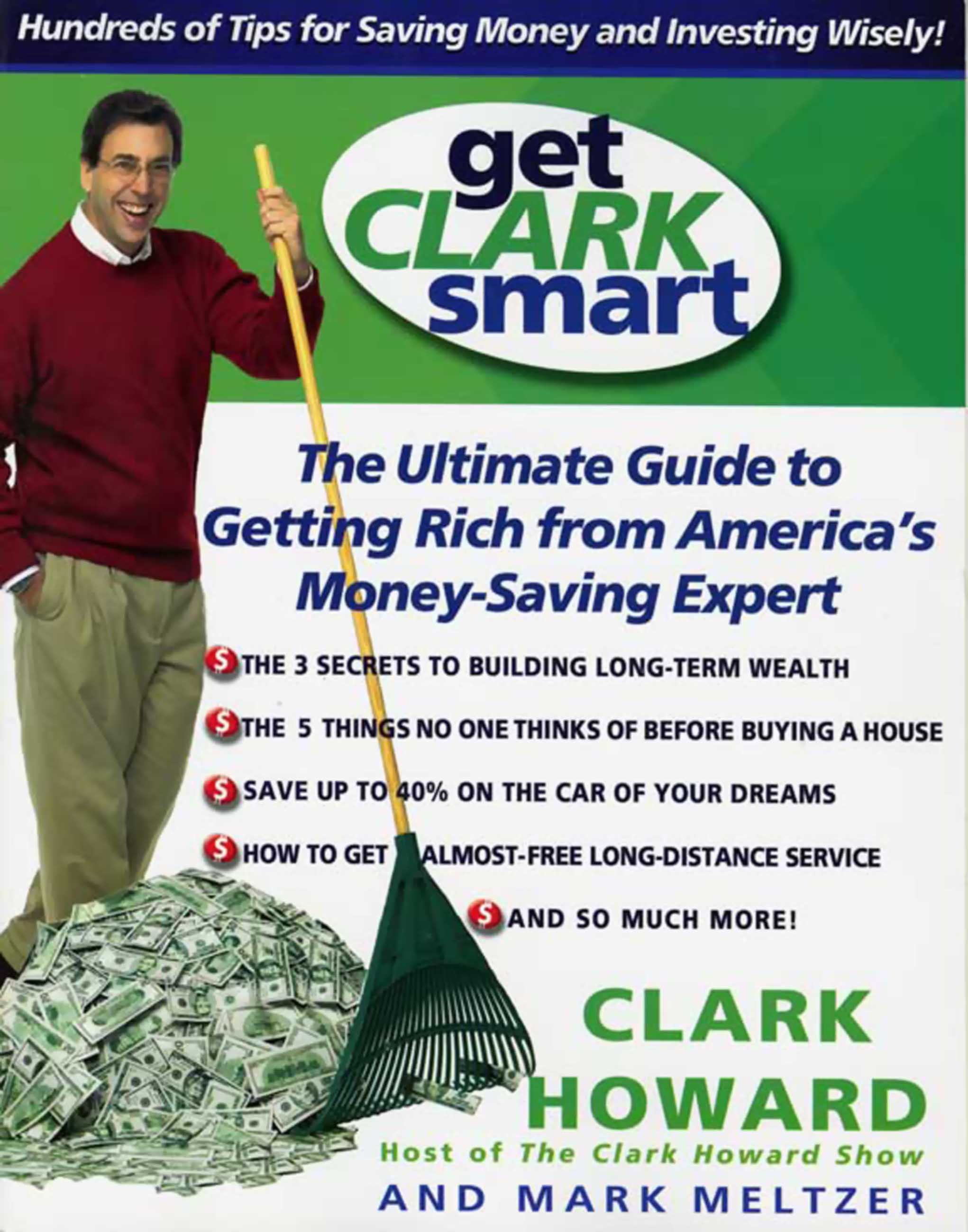

Get Clark Smart

The Ultimate Guide to Getting Rich from America's Money-Saving Expert

Contributors

By Clark Howard

By Mark Meltzer

Formats and Prices

- On Sale

- Sep 1, 2002

- Page Count

- 283 pages

- Publisher

- Grand Central Publishing

- ISBN-13

- 9781401397104

Price

$9.99Price

$12.99 CADFormat

Format:

- ebook $9.99 $12.99 CAD

- Audiobook Download (Abridged) $18.99

This item is a preorder. Your payment method will be charged immediately, and the product is expected to ship on or around September 1, 2002. This date is subject to change due to shipping delays beyond our control.

Buy from Other Retailers:

Clark Howard answers all these questions and many more in Get Clark Smart. With practical tips and on-line resources, Howard helps readers to get rich by saving money in unexpected places and investing those savings creatively. Howard has a passion for saving money and a zealots enthusiasm for sharing everything hes learned. His strategies for getting rich by saving wisely will turn readers into financial wizards.

Newsletter Signup

By clicking ‘Sign Up,’ I acknowledge that I have read and agree to Hachette Book Group’s Privacy Policy and Terms of Use