Promotion

Use code SPRING26 for 20% off sitewide.

By clicking “Accept,” you agree to the use of cookies and similar technologies on your device as set forth in our Cookie Policy and our Privacy Policy. Please note that certain cookies are essential for this website to function properly and do not require user consent to be deployed.

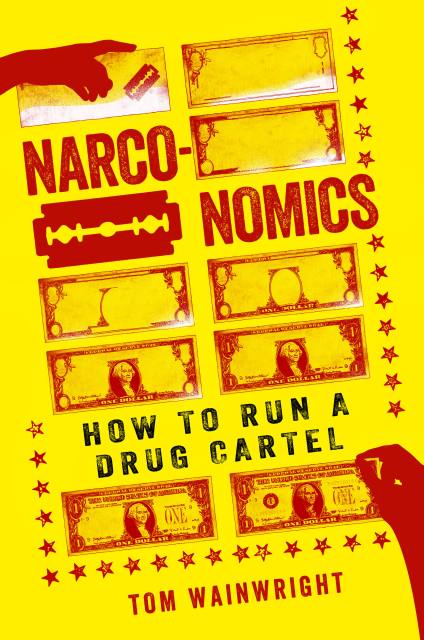

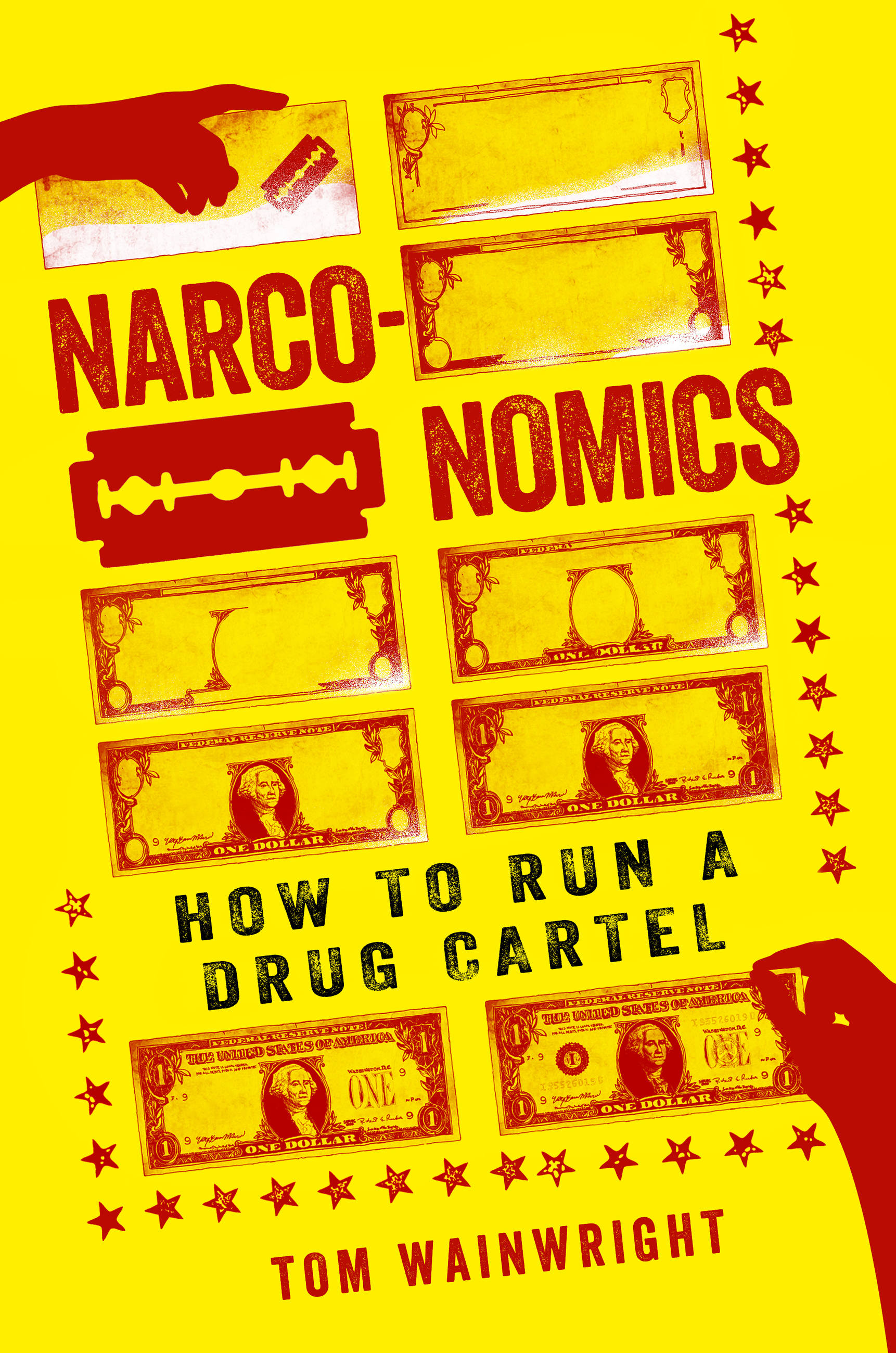

Narconomics

How to Run a Drug Cartel

Contributors

Formats and Prices

- On Sale

- Apr 11, 2017

- Page Count

- 288 pages

- Publisher

- PublicAffairs

- ISBN-13

- 9781610397704

Price

$19.99Price

$25.99 CADFormat

Format:

- Trade Paperback $19.99 $25.99 CAD

- ebook $11.99 $15.99 CAD

This item is a preorder. Your payment method will be charged immediately, and the product is expected to ship on or around April 11, 2017. This date is subject to change due to shipping delays beyond our control.

Buy from Other Retailers:

How does a budding cartel boss succeed (and survive) in the $300 billion illegal drug business? By learning from the best, of course. From creating brand value to fine-tuning customer service, the folks running cartels have been attentive students of the strategy and tactics used by corporations such as Walmart, McDonald’s, and Coca-Cola.

In Narconomics, Tom Wainwright is an intrepid guide to the most exotic and brutal industry on earth. Picking his way through Andean cocaine fields, Central American prisons, and communities where the cartels rule, Wainwright offers a vivid, fresh, and innovative look into the drug trade and its 250 million customers. More than just an investigation of how drug cartels do business, Narconomics is also a keen and daring blueprint for how to defeat them.

-

“[Tom Wainwright] brings a fine and balanced analytical mind to some very good research. By looking at the drug trade as a business, Wainwright is able to reveal much about why it wreaks such havoc in Central and South America. Wainwright show[s] how drug violence is not so much senseless but the devastating result of economic calculations taken to their brutal extreme. [His] conclusion is titled ‘Why Economists Make the Best Police Officers.’ It is one of the pithiest and most persuasive arguments for drug law reform I have ever read.”Misha Glenny, New York Times Sunday Book Review

-

“A lively and engaging book, informed by both dogged reporting and gleanings from academic research...”Wall Street Journal

-

“A cracking read… both an extended black joke and a hard-headed analysis of the economics of getting high.”Reuters

-

“An economics book for the Breaking Bad generation”Times (London)

-

“Tom Wainwright of the Economist brings a fine and balanced analytical mind to some very good research”Minneapolis Star Tribune

-

“Tom Wainwright has powerfully argued in favor of legalizing drugs. He says that the policies aimed at stifling the drug trade seem to be misdirected and have failed... a controversial but well‑argued book... a must‑read for everyone interested in solving the drug issue. Wainwright makes a lot of sense at a time when the world seems helpless against drug traffickers.”Washington Book Review

-

“Readers interested in the intersection of crime, economics, entrepreneurship, and law enforcement will find this work fascinating.”Library Journal