By clicking “Accept,” you agree to the use of cookies and similar technologies on your device as set forth in our Cookie Policy and our Privacy Policy. Please note that certain cookies are essential for this website to function properly and do not require user consent to be deployed.

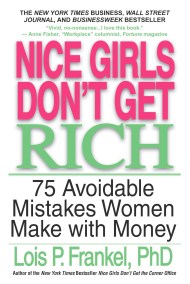

Nice Girls Don’t Get Rich

75 Avoidable Mistakes Women Make with Money

Contributors

Formats and Prices

- On Sale

- Oct 31, 2009

- Page Count

- 288 pages

- Publisher

- Business Plus

- ISBN-13

- 9780446568647

Price

$7.99Price

$15.99 CADFormat

Format:

- ebook $7.99 $15.99 CAD

- Trade Paperback $18.99 $23.99 CAD

This item is a preorder. Your payment method will be charged immediately, and the product is expected to ship on or around October 31, 2009. This date is subject to change due to shipping delays beyond our control.

Buy from Other Retailers:

If you have outstanding balances on your credit cards…don't have assets in your own name…are saving instead of investing, then chances are you're not rich and not living the life you want. Without your awareness, behaviors learned as a girl are preventing you from becoming a woman who is financially independent and free to follow her dreams.

Lois Frankel isolates the messages about money given to little girls that little boys never hear. Then she helps you discover the financial thinking that is keeping you stuck in old patterns, dependent relationships, and jobs where you earn less than you deserve. Once you get to the root of the problem, Frankel helps you solve it-with fabulous results. Her coaching tips help you take control of your finances and make more money than you ever thought possible. Do you make these "nice girl" mistakes?

Mistake #4: Not playing to win. Being polite, quiet, and fair to a fault is playing the financial game "like a girl."

Mistake #10: Choosing to remain financially illiterate. Knowledge is power. Learn to manage your major purchases, investments, and banking.

Mistake #20: Spending as an emotional crutch. Understand your emotions; don't make purchases just to lift your spirits.

Mistake #45: Saving instead of investing. Fear can keep your funds in low-interest accounts. Get educated about investing. Get wealthy. Frankel gives you the financial savvy to change negative behaviors, make smart money choices, and embrace the life you want sooner than you think.

Series:

Newsletter Signup

By clicking ‘Sign Up,’ I acknowledge that I have read and agree to Hachette Book Group’s Privacy Policy and Terms of Use