By clicking “Accept,” you agree to the use of cookies and similar technologies on your device as set forth in our Cookie Policy and our Privacy Policy. Please note that certain cookies are essential for this website to function properly and do not require user consent to be deployed.

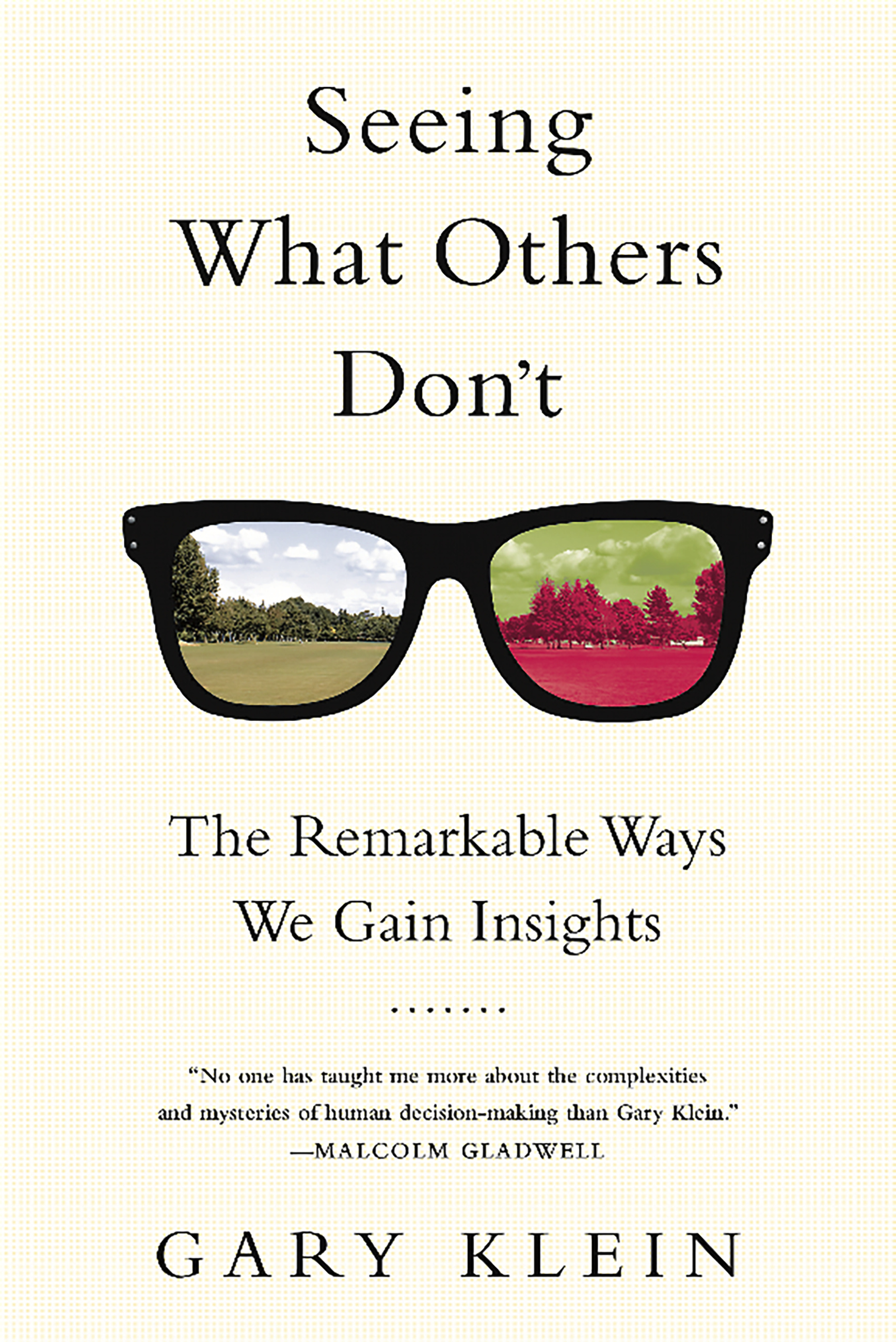

Seeing What Others Don’t

The Remarkable Ways We Gain Insights

Contributors

By Gary Klein

Formats and Prices

- On Sale

- Mar 24, 2015

- Page Count

- 304 pages

- Publisher

- PublicAffairs

- ISBN-13

- 9781610393829

Price

$19.99Price

$25.99 CADFormat

Format:

- Trade Paperback $19.99 $25.99 CAD

- ebook $11.99 $15.99 CAD

This item is a preorder. Your payment method will be charged immediately, and the product is expected to ship on or around March 24, 2015. This date is subject to change due to shipping delays beyond our control.

Buy from Other Retailers:

Insights — like Darwin’s understanding of the way evolution actually works, and Watson and Crick’s breakthrough discoveries about the structure of DNA — can change the world. We also need insights into the everyday things that frustrate and confuse us so that we can more effectively solve problems and get things done. Yet we know very little about when, why, or how insights are formed — or what blocks them. In Seeing What Others Don’t, renowned cognitive psychologist Gary Klein unravels the mystery.

Klein is a keen observer of people in their natural settings — scientists, businesspeople, firefighters, police officers, soldiers, family members, friends, himself — and uses a marvelous variety of stories to illuminate his research into what insights are and how they happen. What, for example, enabled Harry Markopolos to put the finger on Bernie Madoff? How did Dr. Michael Gottlieb make the connections between different patients that allowed him to publish the first announcement of the AIDS epidemic? What did Admiral Yamamoto see (and what did the Americans miss) in a 1940 British attack on the Italian fleet that enabled him to develop the strategy of attack at Pearl Harbor? How did a “smokejumper” see that setting another fire would save his life, while those who ignored his insight perished? How did Martin Chalfie come up with a million-dollar idea (and a Nobel Prize) for a natural flashlight that enabled researchers to look inside living organisms to watch biological processes in action?

Klein also dissects impediments to insight, such as when organizations claim to value employee creativity and to encourage breakthroughs but in reality block disruptive ideas and prioritize avoidance of mistakes. Or when information technology systems are “dumb by design” and block potential discoveries.

Both scientifically sophisticated and fun to read, Seeing What Others Don’t shows that insight is not just a “eureka!” moment but a whole new way of understanding.

-

"No one has taught me more about the complexities and mysteries of human decision-making than Gary Klein."Malcolm Gladwell

-

"Brilliant discourse on a fascinating subject. It's written in a crisp, fluent, Gladwellish way and the pages flit by"Management Today

-

"His analysis of how Google searches and corporate culture inhibit insight is intriguing, while suggestions for improving the chances of having a breakthrough are practical and useful for many facets of life"Publishers Weekly

-

"Intriguing findings that should play a transformative role, not only in the field of psychology, but also in corporate boardrooms."Kirkus Reviews

-

"A valuable resource for business professionals to return to over again"Library Journal

-

"Written in a breezy yet informative conversational style, Seeing What Others Don't is a good read and helps to stimulate our own thinking about how insights occur"Strategy & Leadership

-

"Gary Klein pins down what until now has been the elusive topic of insight in his best and most personal work yet. The examples are memorable and Klein translates them into subtle and powerful lessons for practitioners and academics alike."Karl Weick, Rensis Likert Distinguished University Professor, Emeritus, University of Michigan

-

"Gary Klein's brilliant book is a superb analysis of why and how some people are able to understand things others do not. As one of Gary's students and disciples I can attest to the exceptional value his insights have added to my own leadership and decision making ability. This new book is a must read for all leaders and should be added to his other works as the definitive collection on how decisions are, and should be, made."General Anthony C. Zinni USMC (Retired)

Newsletter Signup

By clicking ‘Sign Up,’ I acknowledge that I have read and agree to Hachette Book Group’s Privacy Policy and Terms of Use